At a glance: Budget'23

✍️ Himanshu Kumar & Ayushmaan Singh

Published: 2023-02-15

It’s time for the First Edition of MUNSOC Newsletter, and this time we’re taking a closer look at the Union Budget 2023. The Finance Minister, NirmalaSitharaman , presented the budget on 1st Feb 2023, and there are several key highlights that we think are worth sharing with you. The union budget is the most important political statement that a government makes on the economy of a country and it sets the theme for the central direction of the countryʼs growth. The 2023 Union Budget is rather significant since it is the last full budget of the second Modi government and sets the theme for the 2024 Lok Sabha Elections. The 2023 Union Budget presented by India’s Finance Minister Nirmala Sitharaman focuses on seven key areas : inclusive development, reaching thelast mile, infrastructure and investment, unleashing potential, green growth, youth power, and the financial sector. The Indian government’s revenue in 2023-24 comes mainly from taxes (58 paise in every rupee) and borrowings (34 paise in every rupee). The largest expenses are interest payments (20 paise in every rupee) and the states’ share of taxes and duties (18 paise in every rupee).

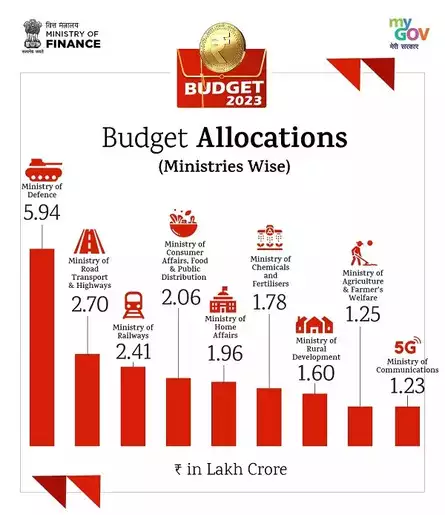

Allocation for defence stands at 8 paise.Expenditure on central sector schemes will be 17 paise out of every rupee, while the allocation for centrally-sponsored schemes is 9 paise.The expenditure on ‘Finance Commission and other transfers’ is pegged at 9 paise. Subsidies and pension will account for 9 paise and 4 paise, respectively.The government will spend 8 paise out of every rupee on ‘other expenditures’.

Here are the major announcements in the important sectors of our economy.

CLEAN ENERGY:

The budget has a strong focus on clean energy and sustainable growth, and these initiatives are aimed at promoting the use of clean energy sources in the country and reducing dependence on fossil fuels. The priority capital ofRs 35,000 crores is expected to provide a boost to the energy transition , while the green creditprogram under the Environment Protection Act is aimed at encouraging sustainable practices in various industries.

The viability gap funding for battery storage is expected to encourage the adoption of battery storage systems, which will help in stabilizing the grid and reducing dependence on fossil

fuels. The national green hydrogen mission with an outlay of Rs 19,700 crore is expected to promote the use of hydrogen as a clean energy source and make India a leader in this technology.

TAXES:

The 2023 Budget has announced a new tax regime as the default option, but individuals can still choose the old regime. Under the new regime, there will be no tax on annual income up to Rs 7.5 lakh with the inclusion of a standard deduction of Rs 50,000. The highest surcharge rate has been reduced from 37% to 25%. The new taxslabs are as follows: 0-3 lakhs (Nil), 3- lakhs (5%), 6-9 lakhs (10%), 9-12 lakhs (15%), 12-15 lakhs (20%), and over 15 lakhs (30%). The standard deduction and the reduction in surcharge rate will result in lower taxes for individuals.

The government has also introduced new measures such as TDS on online game winnings and higher exemptions on leave encashment on retirement for non-government employees. Additionally, the TDS rate on EPF withdrawal in non-PAN cases has been reduced from 30% to 20%.

SPACE:

The allocation of Rs 12,544 crore to the Departmentof Space , highlights the government’s commitment to the development and advancement of the Indian space program. The allocation for IN-Space, which is the newly formed Indian National Space Promotion and Authorization Center, has seen a significant increase from the revised estimate of Rs 21 crore to Rs 95 crore, with a large portion of the allocation going towards capital expenditure for INSPACe.

The Physical Research Laboratory (PRL) , a premierresearch institute in the field of space science, has received an allocation of Rs 408.69 crore. This allocation will enable PRL to carry out its research activities and contribute to the growth and development of the Indian space program.

Overall, the allocation to the Department of Space and its affiliated institutions showcases the government’s focus on the growth and development of the Indian space industry and its determination to make India a major player in the global space arena.

SPORTS:

The allocation of Rs 3,397.32 crore to the sports sector in the Union Budget 2023 of India is a significant increase from the previous budget andmarks a new milestone in the government’s efforts to promote sports and fitness in the country. This allocation of Rs 3,397.32 crore is the highest sports budget allocation ever in India andreflects the government’s commitment to creating a sporting culture in the country.

The allocation to ‘Khelo India,’ a flagship programof the government to promote sports among the youth, has been increased to Rs 1,045 crore, which will help to create a conducive ecosystem for sports and physical fitness in the country.

The Sports Authority of India (SAI) has received an allocation of Rs 785.52 crore for the financial year 2023-24, which will help to upgrade the existing sports infrastructure and create new facilities to promote sports and fitness activities.

DEFENCE:

The Defence Budget for the fiscal year 2023 has been increased to Rs 5.94 lakh crore, which is an increase of 13% from the previous year’s budget of Rs 5.25 lakh crore. A significant portion of the defence budget, Rs 1.62 lakh crore, has been set aside for capital expenditure, which includes the purchase of new weapons, aircra, warships, and other military hardware.

The capital budget of the Border Roads Organisation has also been increased to Rs 5, crore. The Indian Air Force received the highest capital outlay of Rs 57,137.09 crore, followed by the Indian Navy with Rs 52,804 crore and the Army with Rs 37,241 crore.

The allocation for the Defence Research and DevelopmentOrganisation (DRDO) has been put at Rs 23,264 crore , which indicates the importancegiven to research and development in the defence sector.

The defence budget, along with the capital expenditure, is crucial for modernising the Indian military and ensuring its readiness to meet current and future security challenges.

DIGITAL SERVICES:

The 2022-2023 Union Budget of India focuses on promoting digital-first approach by expanding DigiLocker services and setting up 100 labsfor 5G application development. The third phase of the E-courts project and partnerships with industry players aim to improve justice and bring new technologies to health, agriculture, and other sectors. The allocation of Rs 10,000 crore for urban infrastructure and incentivesfor cities to improve creditworthiness will improve urban infrastructure and sanitation. These initiatives aim to promote technology, improve services, and drive innovation and growth.

HEALTH:

The Union Budget allocates Rs 89,155 crore for thehealth sector with focus on improving healthcare and facilities, including a mission to eliminate sickle cell anaemia by 2047. The allocation of Rs 86,175 crore to the Department of Health and Family Welfare and Rs 2, crore to Department of Health Research will improve healthcare services. Increased budget for Pradhan Mantri Swasthya Suraksha Yojana, National Health Mission, and AYUSH ministry, as well as National Digital Health Mission and National Tele Mental Health Programme, will expand access to quality healthcare services. Budget for autonomous bodies also increased.The allocation for ICMR has been increasedfrom Rs 2,116.73 crore to Rs 2,359. crore.

EDUCATION:

The Union Budget announces the creation of a National Digital Library for children and adolescents. The National Book Trust and Children’s Book Trust will add non-curricular titles in regional languages and English to the digital libraries. States are encouraged to set up physical libraries and provide infrastructure to access National Digital Library resources. The budget also includes the establishment of three AI centres of excellence in top educational institutions, 157 new nursing colleges, and Eklavya Model Residential Schools. The center plans to recruit 38,800 teachers and staff for 740 schools serving 3.5 lakh tribal students. A National Data Governance Policy will be introduced to support innovation and research by start-ups and academia.

Grant for University Grants Commission (UGC) has been increased by Rs 459 crores (9. pc). Central Universities have been increased by 17.66%,Deemed University by 27%, support to IITs have been increased by 14%, and to NITs by 10.5% as compared to BE 2022-23.

INDIRECT TAXES:

In the 2023 budget, the Indian government made several announcements regarding indirect taxes. The government has increased the tax rate on certain cigarettes by 16%. To encourage the growth of new cooperatives in the manufacturing sector, a lower tax rate of 15% has been proposed for those that start manufacturing by March 2024. In order to promote the domestic manufacturing of televisions, the customs duty onopen cells of TV panels has been reduced to 2.5%.

The import duty on silver bars has been increased to align it with gold and platinum. In addition, the customs duty cut on the import of parts of mobile phones has been extended by 1 year. Concessional duty on lithium-ion cells for batteries has also been extended for another year to promote the domestic production of batteries. The government has reduced the number of basic custom duty rates on goods other than textiles and agriculture from 21 to 13, leading to minor changes in taxes on certain items such as toys, bicycles, and automobiles.

SAVING SCHEMES ANNOUNCEMENTS:

The Indian government has announced several new saving schemes in its 2023 budget, aimed at boosting savings and providing incentives to taxpayers. The maximum deposit limit for the Senior Citizen Savings Scheme has been increased fromRs 15 lakh to Rs 30 lakh , while the monthly income scheme limit has been doubled to Rs 9 lakh and Rs 15 lakh for joint accounts. A new one-time saving scheme, the Mahila Samman SavingCertificate , has been introduced for women, with a deposit facility of up to Rs 2 lakh for a tenure of 2 years at a fixed interest rate of 7.5 percent, with partial withdrawal options.

Additionally, the cap on penal charges on missed loan payments has been introduced. These new savings schemes are aimed at providing financial security and incentives to citizens, particularly women, and encouraging them to save more for their future.

RAILWAY AND CAPEX:

The Indian Railways received a significant boost in the recent budget announcement. The government has allocated a record high of Rs 2.4 lakhcrore for the railways in FY24, which is nearly nine times more than the allocations in FY14. The allocation for track renewal has also been increased from Rs 15,388.05 crore in the Revised Estimate 2022-23 to Rs 17,296.84 crore for the current year. The Railways is planning to roll out 75 Vande Bharat trains by August

Additionally, there has been a 33% hike in capital investment to Rs 10 lakh crore to enhance growth potential, job creation, encourage private investments, and provide a cushion against global headwinds. The effective capital expenditure of the center is expected to be Rs 13. lakh crore in FY24, which is 3.3% of the GDP. A new Infrastructure Finance Secretariat has also been established to increase opportunities for private investment in infrastructure

MSMEs ,BANKING AND EMPLOYMENT:

Micro, Small and Medium Enterprises (MSMEs) play a crucial role in the Indian economy by providing employment opportunities and contributing to the country’s GDP. To support this sector, the Indian government has announced a revamped credit guarantee scheme for MSMEs which will come into effect from April 1, 2023. The scheme will be infused with Rs 9,000 crore in its corpus and will provide additionalcollateral-free guaranteed credit of Rs 2 lakh crore, which is expected to reduce the cost of the credit by about 1 percent. This move is expected to provide a much-needed boost to the MSME sector and help it overcome the challenges posed by the pandemic.

AGRICULTURE:

An Agriculture Accelerator Fund will be set up to encourage agri-startups by young entrepreneurs.Rs 20 lakh crore agricultural credit targeted at animal husbandry, dairy and fisheries.Over the next 3 years, one crore farmers will get assistance to adopt natural farming.10,000 bio input resource centres will be set up.

Central assistance of Rs 5,300 crore to be given tothe upper Badra project in drought-prone central regions of Karnataka. 500 new ʻwaste to wealthʼ plants under GOBARdhan.

TOURISM:

As part of promoting tourism , 50 tourist destinations will be selected through a challenge mode to be developed as a comprehensive package for both domestic and international tourism. These destinations will be developed with the aim of providing a world-class experience to tourists and to promote India as a top tourist destination.

To further support the tourism sector, the government has also encouraged states to set up a ‘Unity Mall’ in their state capital or the most populartourist destination in the state. These malls will serve as a platform for the promotion and sale of local and traditional handicras, and will provide a boost to the local economy.

Overall, the measures outlined in the Union Budget 2023 of India demonstrate the government’s commitment to promoting tourism in the country and its recognition of the significant role that tourism can play in the growth and development of the Indian economy.

EASE OF DOING BUSINESS:

The government’s focus on ease of doing business is aimed at promoting a business-friendly environment and encouraging investment in the country.

The introduction of the Vivad Se Vishwas-2 schemeis aimed at settling commercial disputes and providing a quick and efficient resolution mechanism. The use of PAN as a common identifier for all digital systems of government agencies is aimed at streamlining the processes and making it easier for businesses to interact with the government. The one-stop solution for reconciliation and updating identity, which will be established using Digi Locker and Aadhaar, is expected to simplify the process of identity verification.

The establishment of the Central Processing Centre is expected to speed up the response to companies filing forms under the Companies Act. The reduction of over 39,000 compliances and the decriminalisation of over 3,400 legal provisions are expected to enhance the ease of doing business. The introduction of the Jan VishwasBill is aimed at further promoting trust-based governance.

Finally, the measures announced by the Finance Minister to enhance business activity in the Gujarat International Finance Tec-City (GIFT City) are expected to promote investment and create job opportunities in this special economic zone.

Overall, these initiatives are expected to make it easier for businesses to operate in India, promote investment and create jobs.

OPINION:

The opposition parties and Chief Ministers of non-BJP-ruled states have criticised the Union Budget 2023 presented by the Modi government. The Budget has been criticized as “anti-poor” and offering no solution to address thecountry’s economic concerns such as unemployment, rising inflation, and growing inequality between the rich and poor. Mamata

Banerjee, Chief Minister of West Bengal, has referred to the budget as “dark” and prepared with an eye on the 2024 Lok Sabha elections. P Chidambaram,a former finance minister and a Congress leader, has criticised the budget for not addressing the concerns of the people and failing to mention the words “unemployment,” “poverty,” “inequality,” or “equity” in the finance minister’s speech. Chhattisgarh Chief Minister Bhupesh Baghel has referred to the budget as “nirmam” (empty) and lacking provisions for various sections of society. The Congress party has also criticised the budget for not addressing the real issues of the country such as unemployment and price rise and for having nothing to offer for the poor people of the country.

I understand the concerns about the budget and its impact on the Indian people. It’s true that the allocation for essential social spending programs like MNREGA, food subsidy, and public health insurance has been reduced, which can have a negative impact on those who rely on these programs for basic necessities. Similarly, the lack of investment in education and healthcare during the pandemic can have long-term consequences for the future of the country and its citizens.

The reduction of the tax surcharge rate on incomeabove Rs 5 crore might seem like a scheme to appease the HNIs but the reason behind the reduction of the tax surcharge rate on income above Rs 5 crore is to increase compliance and generate better revenue for the government. The government hopes that by reducing the tax rate for high-net-worth individuals (HNIs), more wealthy households and individuals will disclose their income, which will lead to better compliance and lower tax evasion and unethical use of tax havens.

The government was concerned about the rising number of citizens giving up Indian citizenship, with estimates suggesting that over 8,000 HNIs could move out of India in 2022. By reducing the tax rate, the government hopes to stop the ʻRichieRichʼ exodus and encourage wealthy individuals to stay and invest in the country and contribute to the economy.

However, it’s important to consider the overall context and challenges that the government is facing, such as the economic impact of the pandemic and the need to revive growth and create employment opportunities. The emphasis on infrastructure investment and production-linked incentive schemes can have a positive impact on the economy and job creation, which could eventually benefit a larger segment of the population.

It’s also worth noting that the government has taken steps to simplify the tax regime and provide relief to the middle class through adjustmentsin the tax slabs and the reduction of the maximum marginal tax rate. These measures are expected to encourage consumption and provide a boost to the economy.

In summary, while the budget has its pros and cons, it’s important to keep in mind the bigger picture and the government’s goal of reviving the economy and creating job opportunities. At the same time, it’s crucial for the government to ensure that its policies are equitable and address the basic needs and well-being of the Indian people.